Payroll calculator indiana

Indiana Income Tax Brackets and Other Information. Indiana Taxes range from 323 and county taxes range from 05 to 2864.

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Indiana Tax Information Withholding Requirements.

. Indiana Paycheck Calculator. You can also use the calculator to find out what taxes youll have to. Indiana Paycheck Fast Facts.

Keep in mind that if you begin a. Indiana payroll calculators Latest insights The Hoosier State has a flat income tax system where the income taxes are relatively low compared to the rest of the country. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators.

Back to Payroll Calculator Menu 2014 Indiana Paycheck Calculator - Indiana Payroll Calculators - Use as often as you need its free. Weve designed a handy payroll calculator to help you calculate federal and Indiana payroll taxes. Indiana Indiana Hourly Paycheck Calculator Results Below are your Indiana salary paycheck results.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be. Switch to Indiana salary calculator. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

Use the Indiana paycheck calculators to see the taxes on your paycheck. Change state Check Date General Gross Pay Gross Pay Method. Switch to Indiana dual hourly calculator.

Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. However each county collects taxes at tax rates ranging from 05 to 2864.

Indiana Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. State Date State Indiana Check Date General Gross Pay Gross Pay Method Gross Pay YTD Pay Frequency Use 2020 W4 Federal Filing Status Step 2. Payroll pay salary pay check payroll tax calculator tax calculators salary calculator take home pay calculator payroll hours calculator wage calculator online payroll calculator.

Those rates taken alone would give. Indianas statewide income tax has decreased twice in recent years. Exactly Just Just Exactly How Your Indiana Paycheck Works.

Just enter wage and W-4 information for each employee and the calculator will do the rest effortlessly letting you check off one of the least glamorous to-dos on your list. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Indiana State Income Tax Rates and Thresholds in 2022. It went from a flat rate of 340 to 330 in 2015 and then down to 323 for 2017 and beyond.

A state standard deduction exists in the form of a personal exemption and varies based on your filing status. The Indiana dual scenario salary paycheck calculator can be used to compare your take-home pay in different Indiana salary scenarios. Enter your info to see your take home pay.

Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. Indiana Indiana Gross-Up Calculator Change state Use this Indiana gross pay calculator to gross up wages based on net pay. State Income Tax Indiana has a flat rate of 323.

There are reciprocal agreements for the five states you need to know. The calculator will estimate how much tax is taken from your paycheck in Indiana. Switch to Indiana hourly calculator.

Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Indiana paycheck calculator. All you need to do is enter the necessary information from the employees W-4 form pay rate deductions and benefits. The quantity of federal fees taken away hinges on the information you provided on the W-4 kind.

For sales tax please visit. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana. State Date State Indiana.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Indiana residents only. 081 average effective rate. Indiana Paycheck Calculator Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. This Indiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

The state income tax rate in Indiana is a flat rate of 323. Indiana Paycheck Calculator - SmartAsset SmartAssets Indiana paycheck calculator shows your hourly and salary income after federal state and local taxes. The Indiana Paycheck Calculator will help you determine your paycheck.

The IRS gets the federal taxes withheld from your own wages and sets them toward your yearly taxes. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. The results are broken up into three sections.

Launch Free Calculator OR See Indiana tax rates Federal Payroll Taxes. SUTA runs from 05 and 74. Indiana Salary Paycheck Calculator Payroll check calculator is updated for payroll year 2019 and will calculate the net paycheck amount that an employee will receive based on the gross payroll amount and employees conditions such us marital status frequency of pay payroll period number of dependents federal and state exemptions.

Need help calculating paychecks. It is not a substitute for the advice of an accountant or other tax professional.

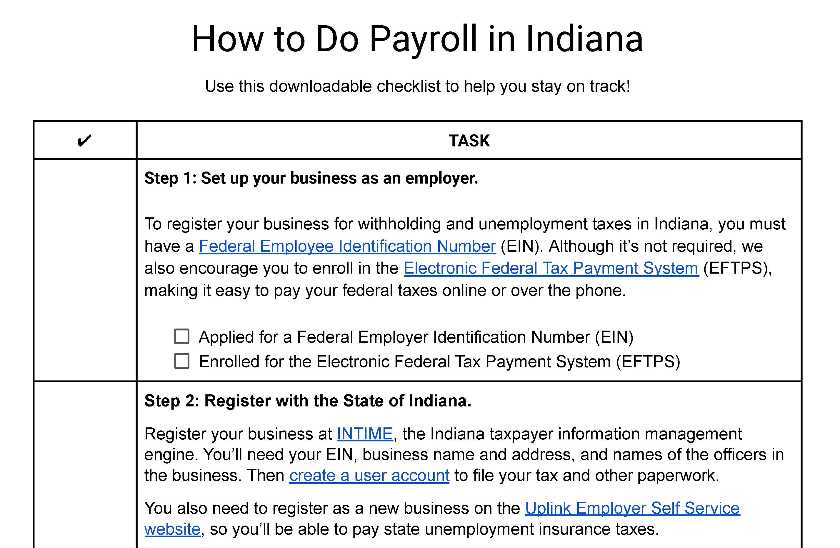

How To Do Payroll In Indiana What Every Employer Needs To Know

Indiana Income Tax Calculator Smartasset

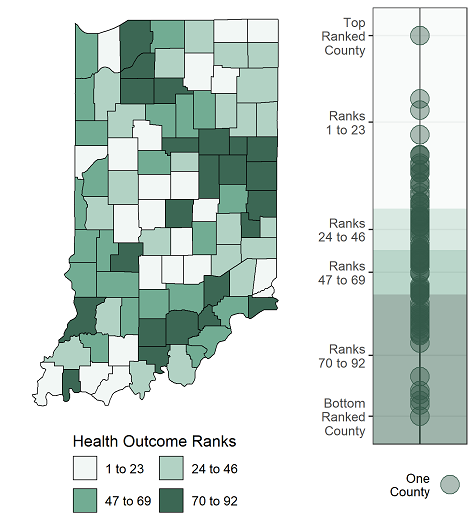

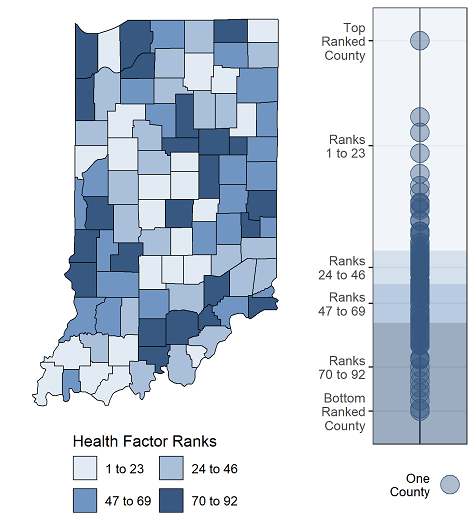

2022 Indiana State Report County Health Rankings Roadmaps

How To Calculate Indiana Income Tax Withholdings

Indiana Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

Indiana Tax Calculator Internal Revenue Code Simplified

Indiana Paycheck Calculator Smartasset

Indiana Salary Calculator 2022 Icalculator

Indiana Sales Tax Calculator Reverse Sales Dremployee

Indiana Paycheck Calculator Tax Year 2022

2022 Indiana State Report County Health Rankings Roadmaps

Indiana Paycheck Calculator Adp

Indiana Moneywise Matters Indiana Moneywise Matters The Anatomy Of Your Paycheck

Define Financial Financial Planner Retirement Financial Planning Certified Financial Planner

Indiana Paycheck Calculator Smartasset

How To Do Payroll In Indiana What Every Employer Needs To Know